Latvian Localization for Dynamics 365 FO

We can provide several localization solutions for Latvian companies – depending on customer size and business processes. OIXIO Digital offers localization in cooperation with SIA Aston Baltic.

- Latvian VAT solution

- Fixed asset extension

- Accounting localization

1. Latvian VAT solution

Solution description

Latvian VAT solution is based on Microsoft Dynamics 365 F&O standard functionality with tailor-made adjustments to meet the requirements of Latvian legislation. Based on available data, the solution automatically arranges VAT transactions into corresponding appendices in accordance with local legislation and requirements.

Main features and benefits of the solution:

- Offers Latvian Report Layout;

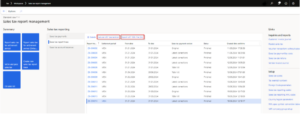

- Offers new workspace built specifically for Latvian VAT reporting;

- Allows user to easily generate, download and submit LV VAT statements along with appendices inclusive of EU sales list (VAT2);

- Allows user to validate data using sales tax report trace and, if necessary, to correct data inconsistencies before settling and reporting VAT;

- Allows user to download all reports in the desired format: xml for submission to the respective tax agency, Excel for easier data validation and /or pdf for storage;

- The solution does not interfere with other countries’ localizations used within an organization.

2. Fixed asset extension

Fixed asset extension is not restricted to Latvian localization, it is implemented across all legal entities after deployment. Fixed asset extension gives user advantages of improved reports and functionality.

Benefits of Fixed asset extension

- 1. Fixed asset record with transactions

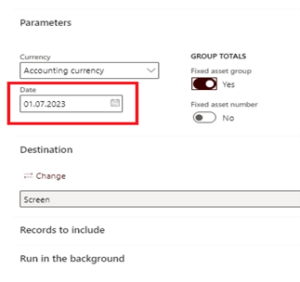

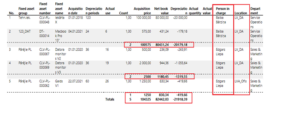

- 2. „Fixed Asset Balances“ report – ability to retrieve data for specified date

- 3. „Asset Accounting Report“ that includes commission members and subtotals

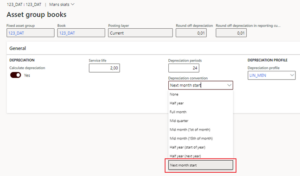

- 4. Fixed asset depreciation calculation starting from the next month

- 5. New functionality – asset mass transfer

- 6. Fixed asset acquisition date/price and dimension in Fixed asset card

- 7. Fixed asset posting profile from fixed asset card

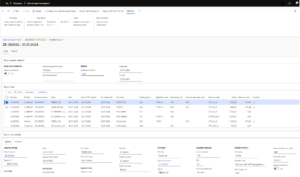

Fixed asset record with transactions

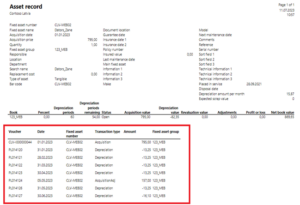

„Fixed Asset Balances“ report

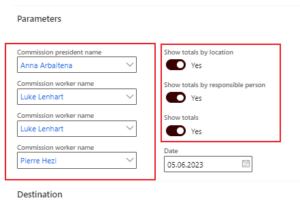

„Asset Accounting” report

Fixed asset depreciation calculation

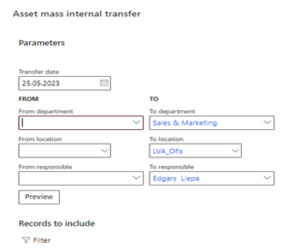

Asset mass transfer

This functionality allows to make mas transfers of fixed assets:

- From one department to another

- From one location to another

- From one responsible person to another

This feature proves beneficial when there are changes in employees responsible for fixed assets.

Fixed asset acquisition date/price and dimension in Fixed asset card

* Microsoft standard – when creating a new Fixed asset card, we indicate the date of Fixed asset acquisition, price, and dimensions. However, if this information is changed in the acceptance operating document, it is not overwritten in the Fixed asset card.

*Development – when creating a new Fixed asset card, we indicate the date of Fixed asset acquisition, price, and dimensions. But if this information is changed or supplemented during acceptance into operation, it is also overwritten in the Fixed asset card.

Fixed asset posting profile

If there are multiple Fixed asset posting profiles and no default profile is specified in the fixed asset parameters, the posting method is determined based on the profile specified in the fixed asset card. This functionality is not available in MS standard.

3. Accounting localization

This solution includes various additions to Microsoft functionality in the General Ledger, Debtors, Creditors modules, which provide more convenient work for accountants in Latvia.

Reports and printouts:

– Creditors/Debtors turnover register – review in various sections, transcripts;

– Creditor/debtor comparison report;

– Combined reports for creditors’/debtors’ balances.

Improved functionality in VG journals:

– Ability to copy lines of an existing posted journal to a new journal;

– Preview of postings before posting;

– Additions to the functionality of importing exchange rates.

Contact Us

OIXIO Group