ASC 842 Solution

OIXIO presents the ASC 842 solution, which provides a comprehensive toolset for automating lease accounting and ensuring compliance to U.S. GAAP ASC 842 standards. The OIXIO ASC 842 solution enables lessees to record, calculate, and manage both finance and operating lease agreements in accordance with ASC 842 principles, covering all recognition, measurement, and reporting aspects.

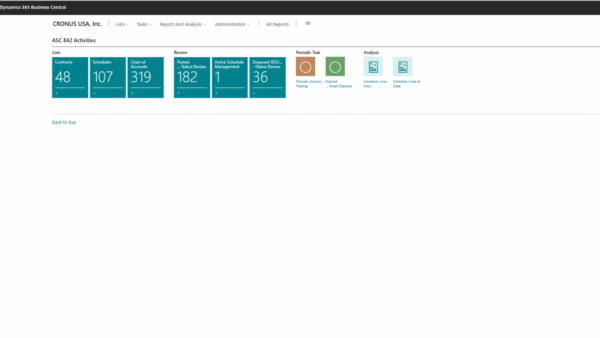

ASC 842 module can be installed into Microsoft Dynamics 365 Business Central or used as a standalone solution, allowing organizations of different sizes to meet regulatory requirements without the need for extensive ERP modifications.

Core Functionalities of ASC 842

The functions of the listed modules are supplemented with specific features to meet the requirements of ASC.

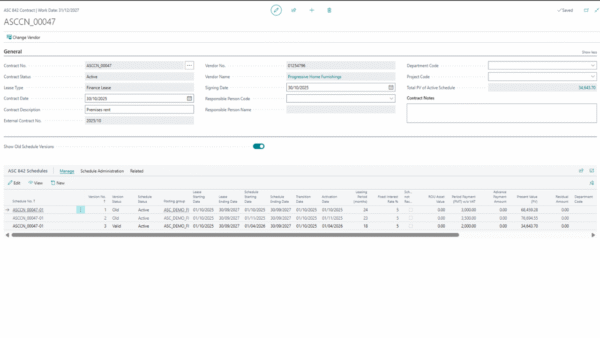

– Ability to define individual lease terms for each lease contract.

– Support for multiple underlying assets within a single lease agreement.

– Possibility to use multiple dimensions for P&L analysis purposes.

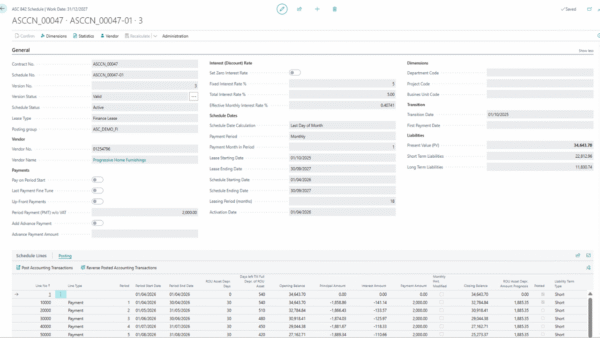

– Present value calculation of lease liabilities based on fixed and variable payments for finance and operating leases.

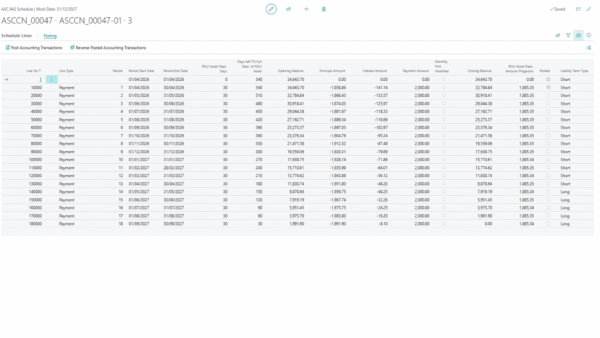

– Allocation of lease payments into principal (liability amortization) and interest expense over the lease term.

– Workflow management for schedule approval, posting, and status tracking.

– Initial recognition of lease liabilities upon lease activation.

– Lease liabilities split into short term and long term.

– Periodical lease liabilities amortization based on calculated schedule.

– ROU Asset book value recognition upon lease activation.

– Periodic ROU Asset depreciation calculation using straight line method (finance lease) or based on calculated schedule (operating lease).

– Handling updates of contract terms, including, lease payments and lease term changes.

– Automated recalculation of lease liability and ROU Asset value.

– Full history tracking of amendments for audit purposes.

– Automated lease liability and ROU Asset disposal at the end of lease term.

– Support for early termination or buyout.

– Tool for uploading historical lease contracts into the system during ASC 842 solution implementation.

– Ability to include full contract information such as lease terms, payments, discount rates, and commencement dates.

– Automatic calculation of lease liability and ROU Asset opening balances based on historical data and lease schedules generation.

– Balance and P&L statements in lease contract level.

– Support for dimension-based analysis (cost centers, departments, locations).

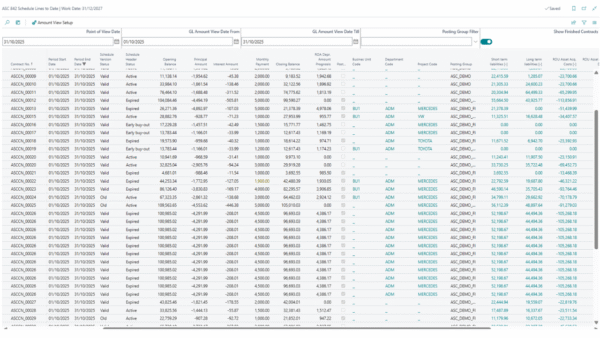

– Schedule lines reports for joining schedule lines and general ledger data.

OIXIO ASC 842 Solution View

Target Audience

ASC 842, effective for reporting periods starting after December 15, 2018, applies primarily to:

- Companies that prepare financial statements under U.S. GAAP.

- Organizations that are lessees of property, plant, or equipment.

- Businesses seeking to enhance financial transparency and comply with updated U.S. accounting standards.

The OIXIO ASC 842 Solution is designed for companies of all sizes that need to automate lease accounting and ensure compliance without extensive ERP customization.

When to Engage

You should consider implementing the OIXIO ASC 842 Solution when:

- Your company prepares financial statements under U.S. GAAP and must comply with ASC 842.

- You are a lessee with one or multiple lease agreements for property, vehicles, or equipment.

- Your current lease accounting process is manual, inefficient, or dependent on spreadsheets.

- You need to streamline lease accounting within your existing ERP system to ensure accuracy and compliance.

Find our solution on Microsoft Marketplace

Solution helps the lessees to support and ensure lease agreements accounting according to ASC842.

Contact Us

Donatas Statulevičius

Linkedin