Every day, thousands of payments and receipts are processed by Baltic companies. Handling them manually is both time-consuming and risky. Finance teams often need to log into multiple banking systems, upload payment files, or manually record bank statement transactions in their ERP – all of which is labor-intensive and prone to errors.

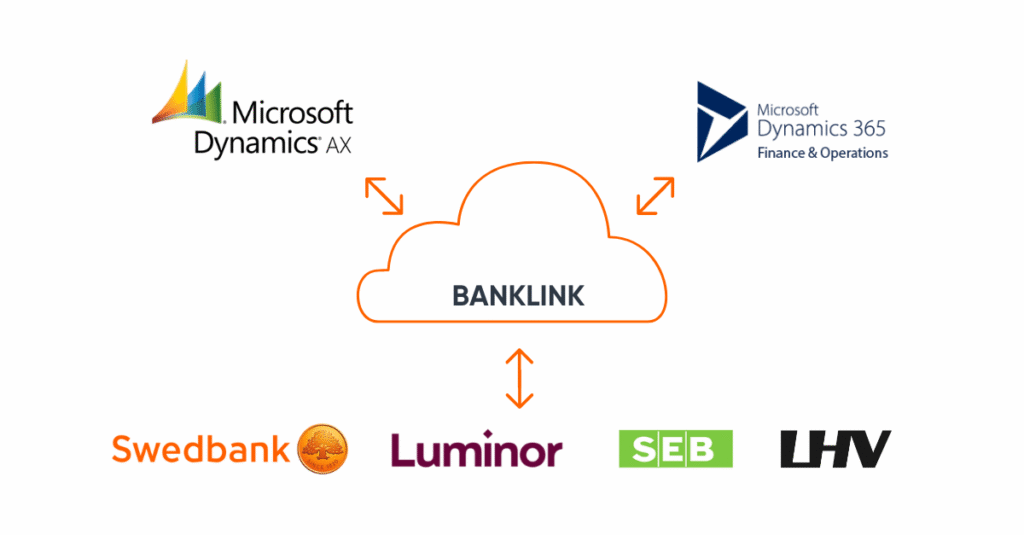

The OIXIO Digital BankLink, built on the Microsoft Dynamics 365 Finance & Operations platform, brings all banking and financial data directly into the ERP system, making processes fast, secure, and fully automated.

How does BankLink work?

The OIXIO Digital BankLink acts as a connector between Microsoft Dynamics 365 Finance & Operations and the major Baltic banks (SEB, Swedbank, LHV, Luminor). The solution allows companies to initiate and approve payments directly from ERP and track payment statuses and bank feedback in real time. It also enables automatic import of bank statements and reconciliation of transactions (including automatic matching of incoming payments to outstanding invoices).

Payments flow between ERP and the bank through a secure channel only – no need to log in to internet banking or manually upload files.

Key features

- Direct transfer of payments to the bank, including digital signatures and real-time status tracking.

- Payments directly from the general ledger journal for intercompany transfers or third-party payments.

- Monitoring of bank account balances: both end-of-day and real-time available funds.

- Automatic bank statement import.

- Full processing of bank statements and automatic creation of accounting entries.

- Automatic matching of incoming payments to open invoices, using either reference numbers or invoice numbers.

- Processing of card payments, including separation of service fees and related accounting entries.

- Automatic handling of foreign currency transactions.

- Salary and payroll payments in bulk.

For Whom is the BankLink for?

BankLink is designed for companies with a high daily volume of transactions that want to:

- Reduce manual work and automate routine processes.

- Ensure greater security and control over payments.

- Improve the user experience within Microsoft Dynamics 365.

The solution brings the greatest benefits to CFOs and accountants by reducing repetitive and time-consuming tasks in their daily work.

Why is BankLink valuable?

Automatic transaction processing – bank statement transactions (customer payments, card transactions, service fees, currency exchanges, etc.) are automatically posted in ERP.

Security – payments are transferred through a secure channel only, eliminating the need to download files or log into online banking.

Time savings – accountants save valuable time by eliminating manual, repetitive tasks and focusing on more important financial processes.

Unified platform – all banking operations are managed directly within Microsoft Dynamics 365 Finance & Operations.

Customer experience

In large companies, manually sending payments to the bank and processing bank statements can take up a significant amount of time for accountants.

Elenger, operating in five markets and serving hundreds of thousands of clients, decided to automate its financial processes. The company implemented the OIXIO Digital BankLink across more than ten group entities, integrated with Microsoft Dynamics 365 Finance & Operations ERP.

“Thanks to BankLink, we have saved valuable time, and our accountants’ daily work has become much more automated.”

— Janne Magnus, Chief Accountant of Elenger Group

Summary

BankLink takes financial processes in Baltic companies to the next level – simpler, faster, and more secure. It helps save time, reduce risks, and gives finance teams greater control over cash flows.

If you’d like to learn how OIXIO Digital BankLink could support your company’s processes, get in touch with us, and we’ll find the best solution together.

Contact Us

OIXIO Group